There were neither any rated municipal defaults in 2018, nor any new defaults in Puerto Rico (although many Commonwealth of Puerto Rico entities remained in default during the year). Likewise when compared to the five-year CDR of 6.6% for global corporates over the same time period.

The report noted, once again, the fundamental difference between municipal and corporate credits.While the five-year all-rated cumulative default rate (CDR) of municipal bonds throughout the study period (1970-2018) might have increased a tiny bit to 0.10% (1970-2017: 0.09%) it still remains quite low. (This enabled more powerful inferences regarding long-term trends.) One important “observation” noted in this year’s report was that, over the 48-year study period: “any one default may only reflect the idiosyncrasies of that individual credit, and not be representative of any general sector trend.” Muni Bond Defaults and Bankruptcies Remain Rare

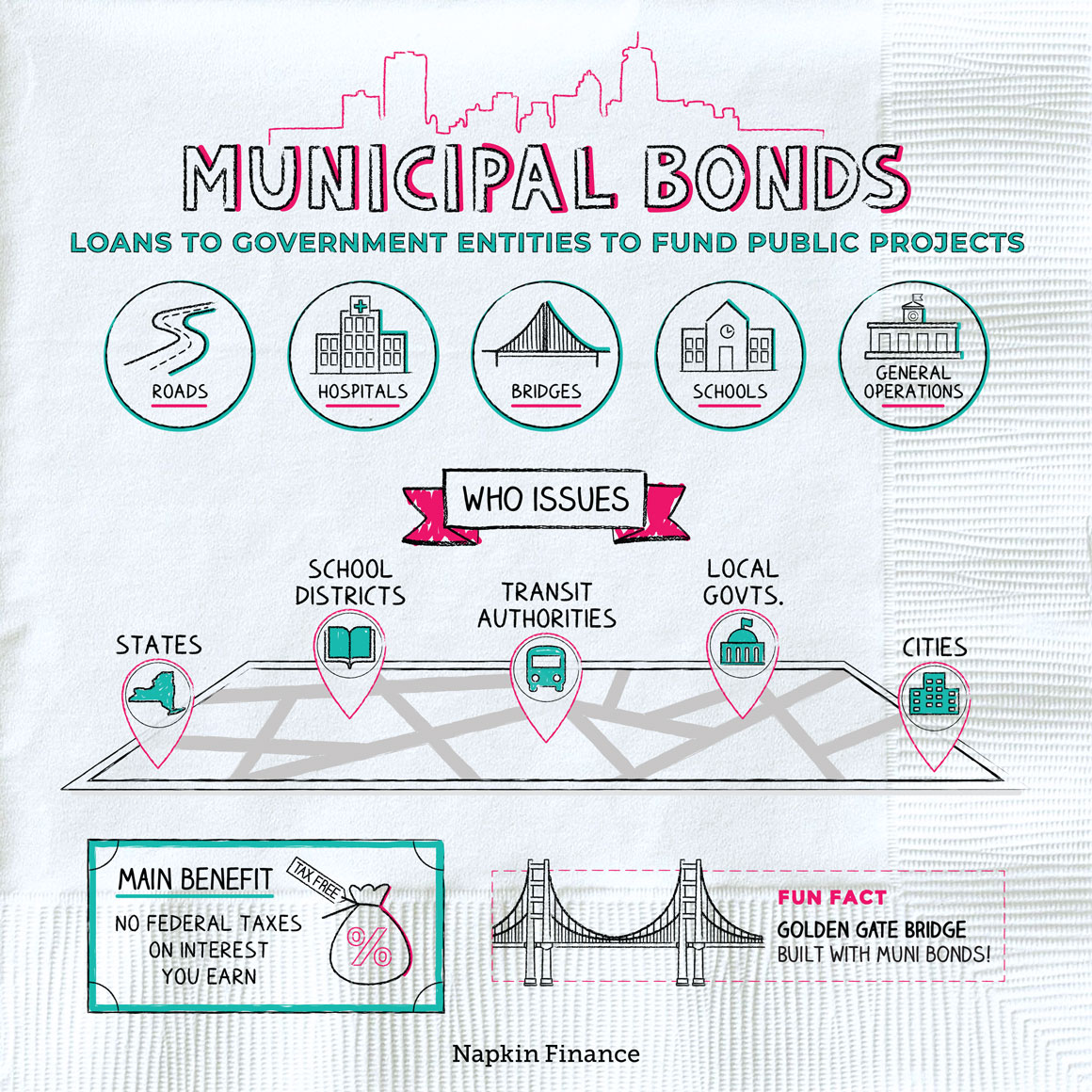

MUNICIPLE BOND DEFAULTS UPDATE

(According to Moody’s, though, on average, the size of the downgrades was larger than for the upgrades.)Last year, we noted that the report featured a significant update to Moody’s entire dataset extending back to 1970 and that the recalculation Moody’s undertook had not only rendered key metrics more meaningful, but also offered greater explanatory power. (There were no rated municipal defaults in 2018.) Second, muni bonds continued to be highly rated in 2018, with more issuers upgraded than downgraded. First, municipal bankruptcies remain rare overall, even though they may have become more common over the last 10 years. The report continues to affirm two hallmark benefits offered by muni bonds. Written by: Michael CohickIn August, Moody’s Investors Service released its annual municipal bond market snapshot, US Municipal Bond Defaults and Recoveries, 1970-2018, with updates through 2018.

0 kommentar(er)

0 kommentar(er)